Investment fund, T Rowe Price, has opposed Michael Dell's plans to take Dell private. For details on the opposition see the WSJ write up here. The gist is that T Rowe Price and Southeastern Asset Management have a blocking position on the deal, but they are crucial players to get the deal done.

Here is what Rotary Gallop’s Control Analysis Reveals:

Here is what Rotary Gallop’s Control Analysis Reveals:

- It is not a surprise that Dell is a prime target for going private. High insider ownership is big plus for these transactions. According to our soon-to-be-released Control and Vulnerability in the S&P500 Study, Dell ranks in the top 10th percentile for insider’s control. They are number 4 in the Information Technology sector and number 1 in their sub industry. (You’ll be hearing a lot more about this study in early March)

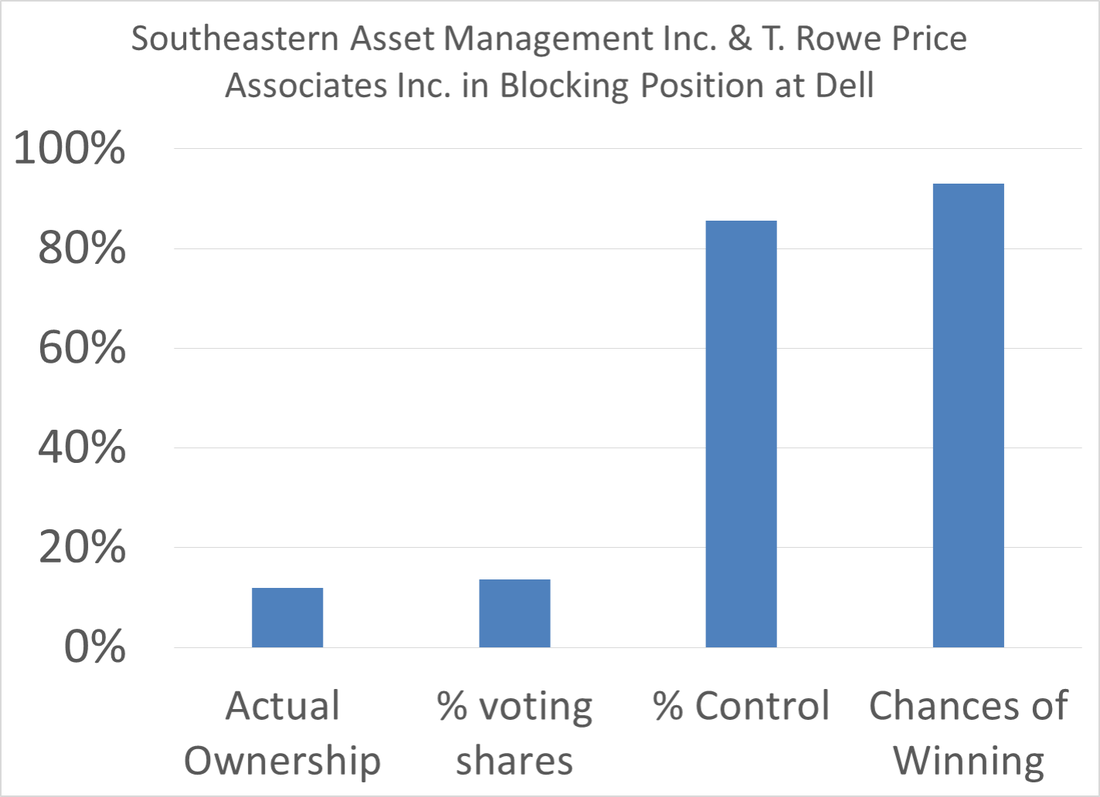

- Because insiders will not be voting, S&T (Southwestern Asset Management + T Rowe Price) has 14% of the effective vote. That is more than 3 times the next largest shareholder.

- This give S&T Control (read the deciding vote) in 86% of all possible outcomes to this shareholder vote, and a 93% chance of winning.

- No one else has control over 12%. Only 4 other shareholders have more than 5% control.

- In order for S&T to lose, there would have to be near-uniform support for the deal from all other shareholders.

- When you add the fact that abstention counts as a no-vote it becomes effectively impossible for Dell to win without S&T's support.

- Therefore if the deal is going to move forward Dell will have to find a way to please S&T.

Note 1: There are two factors that, given reliable information, would improve the calculation:

- An estimate of the percent of outstanding stock that will abstain from voting - This will likely fall somewhere between 5 and 12%. This factor will decrease Dells chances of winning.

- An estimate of the Arb position in the stock and what fraction of it is positioned FOR the deal - This factor may improve Dell's chances of winning, but it depends drastically on the estimate.

RSS Feed

RSS Feed