As we wrote last month, Starboard Value's chances of winning a proxy battle at Office Depot are less than half of what they were at AOL, which didn’t turn out well even with support from ISS. The common problem for Jeff Smith and the Starboard Value team is that in both AOL and now Office Depot, they are at the mercy of a larger shareholder with MUCH more control over the outcome of a proxy battle.

Then: Starboard Value's Proxy Battle Fate at AOL was Decided by One Large Shareholder.

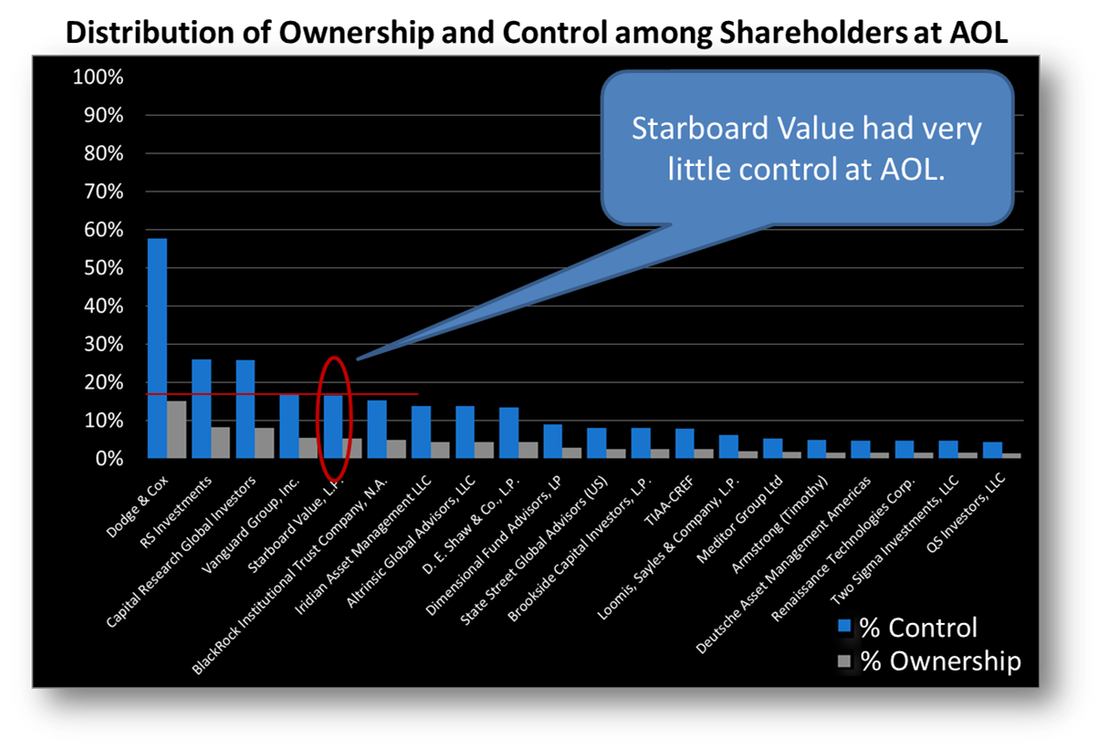

First lets look at what really happened at AOL. As the graph below shows, Starboard had much less control (in blue) in AOL, than top shareholders (see caption for explanation).

Then: Starboard Value's Proxy Battle Fate at AOL was Decided by One Large Shareholder.

First lets look at what really happened at AOL. As the graph below shows, Starboard had much less control (in blue) in AOL, than top shareholders (see caption for explanation).

The Distribution of Control and Ownership Among Shareholders at AOL: This graph shows the percentage Ownership (in grey) and the %Control (in Blue) of the largest shareholder's at AOL prior to the recent Proxy Battle. Notice that in both AOL and ODP (see figure below) Starboard’s Control (circled in red) is very small compared to the larger shareholders. This means that Starboard's proxy future comes down to their ability to convince those few large holders to side with them. In the case of AOL that did not happen.

Starboard Value's control, circled above in red, was only about 17%. That means there was less than a one in five chance that starboard's vote would matter in the proxy battle. Now compare this to the control of the larger shareholders, especially Dodge and Cox who had control in nearly 60% of possible outcomes to the shareholder vote!

Now, Starboard’s chances of winning, on the face of things, didn't look terrible at AOL. After all, There was a 58% chance that they would come out victorious. However, that number changed drastically depending on the vote of a single shareholder, Dodge and Cox. In fact, to a large extent the outcome was determined by which side got Dodge and Cox's vote. When Dodge and Cox eventually decided to vote with management, Starboards chances of winning plummeted to just 29%.

Now, Starboard’s chances of winning, on the face of things, didn't look terrible at AOL. After all, There was a 58% chance that they would come out victorious. However, that number changed drastically depending on the vote of a single shareholder, Dodge and Cox. In fact, to a large extent the outcome was determined by which side got Dodge and Cox's vote. When Dodge and Cox eventually decided to vote with management, Starboards chances of winning plummeted to just 29%.

Aside for proxy battle experts and aspirants: People are generally friendly and will often tell you what you want to hear. It is common for both sides to be sure they have a proxy battle in the bag, because of large shareholders being nice to both sides. It would be unsurprising to learn that both AOL's Management and Starboard Value went into the vote thinking Dodge and Cox was on their side. That is why it is so crucial to use methods of analysis that are able to handle reality: massive uncertainty in how people will vote, even if they have told you they are with you.

Now: Starboard Value's Fate at Office Depot is Also Likely to be Decided by One Large Shareholder

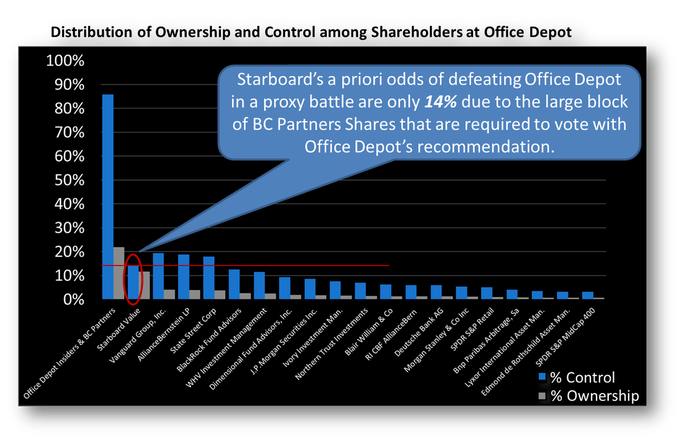

The graph below is the same as above, only now showing the current shareholders in Office Depot. Notice how eerily similar Starboard's strategic position at Office Depot is to AOL:

The graph below is the same as above, only now showing the current shareholders in Office Depot. Notice how eerily similar Starboard's strategic position at Office Depot is to AOL:

- Again Starboard Value is far from the largest shareholder, though much closer here

- Again we have a large shareholder - BC Partners -who basically controls the outcome of a potential proxy battle.

The Distribution of Ownership and Control Among Shareholders at Office Depot: This graph shows the percent ownership (in grey) and the %Control (in Blue) of the largest shareholders at Office Depot today. Notice that in both AOL (above) and ODP, Starboard’s Control (circled in red) is very small compared to the larger shareholders, especially in the case of BC Partners at Office Depot. Note: Here %Ownership is actually percent of the vote, because BC Partners has a large chunk of the vote through preferred shares that do not show up as common-stock ownership.

What does this mean for Starboard Value (and coattailers)?

It's not all bad news for Starboard: Office Depot is deja vu in more ways than one. Though they lost the proxy battle at AOL, some of their proposals were instituted and AOL's stock appreciated by ~70% while they held it. In that sense too, Office Depot looks very similar to AOL. Namely the share price is up 100% since Starboard started buying in. Starboard Value may be losing battles, but so far they are winning the war! And despite the long odds, Starboard appears to be gearing up for a fight, with their recent retainer of Bob Nardelli, the former chief of companies such as Home Depot and Chrysler, and Joseph Vassalluzzo, a former vice chairman of Staples Inc. Both are powerful choices for an opposition slate of directors!

Next time we'll cover the Office Depot innovation that Starboard was attempting to counter with their recent letter to independent directors. Depending on your view, it is either the greatest or the worst thing to hit the field of corporate governance in years. I call it the Permanent White-Knight Defense. Starboard might call it the Chained White Knight Defense. Whatever your take, it makes the poison pill, the subject of much gnashing of teeth, look like a kitten in a pretty pink bow, so tune in next week!

It's not all bad news for Starboard: Office Depot is deja vu in more ways than one. Though they lost the proxy battle at AOL, some of their proposals were instituted and AOL's stock appreciated by ~70% while they held it. In that sense too, Office Depot looks very similar to AOL. Namely the share price is up 100% since Starboard started buying in. Starboard Value may be losing battles, but so far they are winning the war! And despite the long odds, Starboard appears to be gearing up for a fight, with their recent retainer of Bob Nardelli, the former chief of companies such as Home Depot and Chrysler, and Joseph Vassalluzzo, a former vice chairman of Staples Inc. Both are powerful choices for an opposition slate of directors!

Next time we'll cover the Office Depot innovation that Starboard was attempting to counter with their recent letter to independent directors. Depending on your view, it is either the greatest or the worst thing to hit the field of corporate governance in years. I call it the Permanent White-Knight Defense. Starboard might call it the Chained White Knight Defense. Whatever your take, it makes the poison pill, the subject of much gnashing of teeth, look like a kitten in a pretty pink bow, so tune in next week!

RSS Feed

RSS Feed