WSJ's recent in depth write up of the opposition to DELL's going private transaction is unfortunately marred by some shoddy analysis. It is important to highlight because if these kinds of mistakes are made by DELL's advisers it could sink the whole ship.

For the sake of people basing decisions based on the type of information in the WSJ's article, I must take issue with the quoted analysis of Toni Sacconaghi of Sanford Bernstein. Here is the offending paragraph:

For the sake of people basing decisions based on the type of information in the WSJ's article, I must take issue with the quoted analysis of Toni Sacconaghi of Sanford Bernstein. Here is the offending paragraph:

Some analysts said a majority of Dell's shareholder base are still likely to support the deal. Sanford C. Bernstein analyst Toni Sacconaghi estimated that roughly 20% of Dell's shares are owned by merger-arbitrage traders "who will vote for the deal," he said, adding that "nearly 50% of Dell shares outstanding have turned over since the deal first leaked."

Mr. Sacconaghi added that 8% of Dell's owners are passive index funds that "will very likely vote for the deal," and that about 60% of Dell's 25 largest shareholders after Mr. Dell purchased their stock on average at less than $15 a share, "suggesting some among them may support the deal."

The three points attributed to him are all, at best, misleading. I’ll take them one at a time:

- Sanford C. Bernstein analyst Toni Sacconaghi estimated that roughly 20% of Dell's shares are owned by merger-arbitrage traders "who will vote for the deal," he said, adding that "nearly 50% of Dell shares outstanding have turned over since the deal first leaked."

I have no estimate of arbs voting for Dell’s deal and so don’t take issue with the 20% quoted, but left unsaid is Mr Sacconaghi’s guess as to what part of the 30% remaining will likely vote against the deal. Is it 5%(Good for Dell), 20%(Good for Southeastern and T. Rowe), 30%(Very Good for Southeastern and T. Rowe)? These are all very different situations, so without this number, the information contained in this statement is ZERO.

Mr. Sacconaghi added that 8% of Dell's owners are passive index funds that "will very likely vote for the deal,"

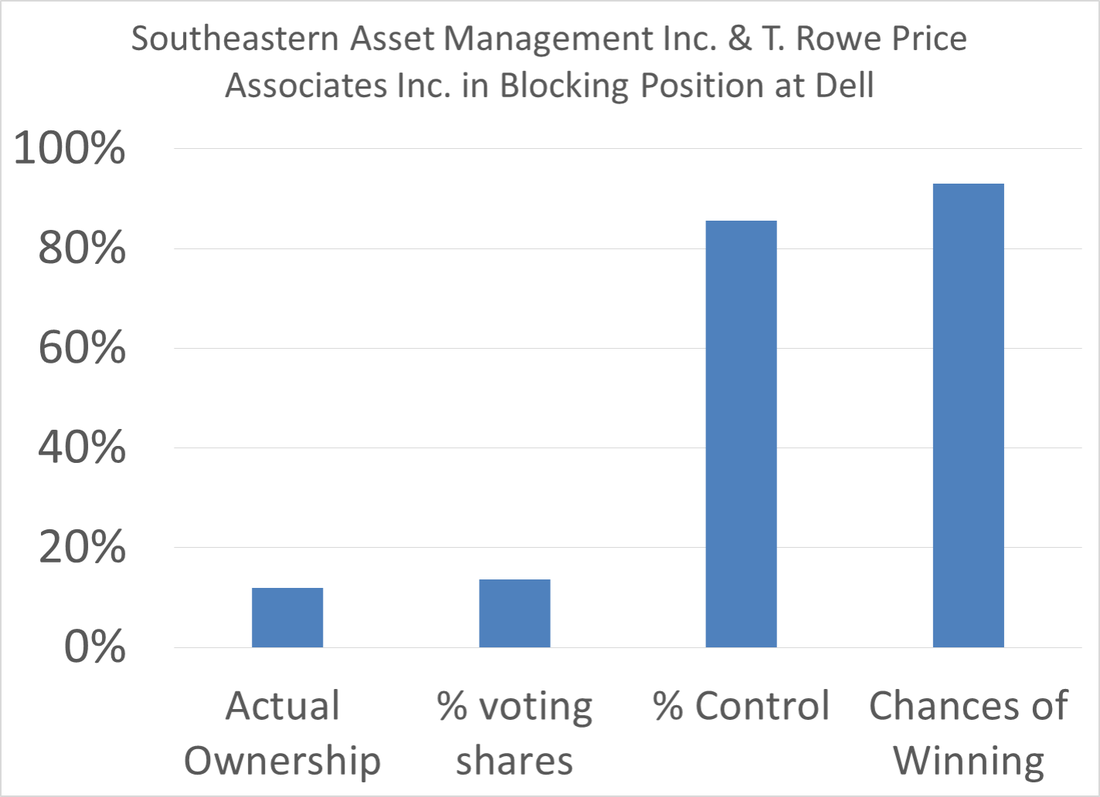

The latter half of this statement is simply not true. Passive index funds tend to vote with management, except when they don’t. The more useful statement is that they tend to vote together and they tend to vote with the crowd. The fact that the two largest shareholders, themselves respected institutional investors, have come out against the deal dramatically raises the chances that the Vanguards of the world with vote against the deal as well. (Get in touch for links to a great academic study on this point)

- and that about 60% of Dell's 25 largest shareholders after Mr. Dell purchased their stock on average at less than $15 a share, "suggesting some among them may support the deal."

This statement also seems completely empty of content. I could simply point to the fuzziness of the quantitative estimate of “some shareholders”, but let’s charitably assume that some shareholders is a lot, say even more than half. We still can’t take anything from this statement because if about half of shareholders (60%) bought their stock at less than $15 (and so some among them might support the deal), then it follows that about half of shareholders (40%) bought their stock at more than $15 (and so some among them might be against the deal). To put things more clearly the whole thing is a wash.

RSS Feed

RSS Feed