The low down on what Carl Icahn, an Activist Investor, is trying at Apple.

‘Big’ must naturally go with ‘Apple’. With more than 900 million shares trading on NASDAQ, at times with over 50 million per day, calling Apple popular is an understatement. From hedge fund managers and analysts to iphone owners, diverse investor groups profess an unconditional love for Apple. Now, the biggest bad boy in finance has shown up at Apple and you see his name plastered across the media: Carl Icahn. But the average household investor has no idea who Carl is, and what activist investors are. Should you worry or rejoice? Do activists tend to propel companies or bring them down?

Typically, my startup Rotary Gallop does not have the pleasure of having its killer app be so relevant to our friends and family – so this post is especially for you. For the lot of you, who don’t know who Carl is and what activists do – typically because they tend to show up at companies with really serious problems and not ones which have the luxury of having more cash reserves than the GDP of more than 70% of the countries. So, here is a FAQ on whats happening at Apple.

Remember, we cannot legally give you financial advice but we can certainly discuss financial activism 101, general trends, and results from Rotary Gallop’s number crunching.

Part I: Financial activists 101 (Skip if this is familiar territory)

Who is Carl Icahn and what does he want with Apple:

Carl Icahn is perhaps the most famous activist investor. An activist investor is someone who thinks they see value in a company that other don’t AND work publicly to make the market recognize that value. So what does Icahn see that others don’t in the most watched stock in the world, Apple?

Cold hard cash to the tune of $150 Billion. To put that in perspective, there are only about 30 companies in the world, that Apple could not buy outright with its cash laying around. If countries were for sale, Apple could own 70% of the world and christen them United States of Apple or Applesia and continue its normal operations. And to relate to the young investors, that’s a 150 Instagram impulse buys Tim Cook can afford!

To any business savvy investor, this kind of immense cash reserves is a huge waste. That’s the equivalent of hiding your savings under the mattress – a strategy most financial advisors advice against. And to activist investors who look to uncover valueat good businesses executing bad strategy, the huge cash reserves are like catnip.

Icahn is asking Apple to use a good chunk of its cash reserves to buy back its own stock.

What value can you uncover at Apple?

Apple is a stock valued largely on matters other than its balance sheet. Some investors value Apple for its earnings, some for growth, for many its new products, or product pipeline, or the fact that Apple users spend vastly more on apps than other platforms. Almost no one values Apple by its balance sheet assets. Thus, a pile of cash worth more than 30% of Apples market cap is an enormous hidden value that makes an activist’s mouth water.

Why do companies need a cash stock pile?

Several good reasons, including the ability to invest in new opportunities, projects, acquisitions, etc.

What do most companies do with their cash stock pile? Give it back to shareholders as dividends or re-invest in opportunities which have potentially higher-than-market returns.

Why will Apple spending its cash to buy back its own stock help uncover value?

In the Short term: Apple, suddenly in the market for 30% of its trading securities, skyrockets the demand for and hence the price of apple stock.

In the Long Term: Since Apple is not primarily valued on its assets but on its earnings, the buyback is unlikely to change the market valuation of the company as a whole. Thus, even once Apple stops buying the share price is likely to trade approximately 1/.7=42% higher.

What is the downside of this stock buyback strategy?

Returning the massive amount of cash back to its investors is great in the short term. The downside is that we won’t get to see what happens 5-10 years from now once Apple has had the chance to invest the largest war chest in history in its business.

Ok. What does all this boil down to?

It comes down to this:

Do you want this massive pile of cash invested by apple and are you willing to wait for when that happens? Or would you rather take that money and invest it elsewhere yourself where the compounding magic can start right away? While that sounds like a flippant question, statistically speaking both are pretty crummy bets.

If you are not a buy and hold type gal/guy, then it really doesn’t matter, does it?

So, what happens now?

Ultimately these disputes are settled by a shareholder vote called a proxy battle, or more often by the threat of a proxy battle.

Part II: How Rotary Gallop’s technology quantitatively reveals what is happening at Apple

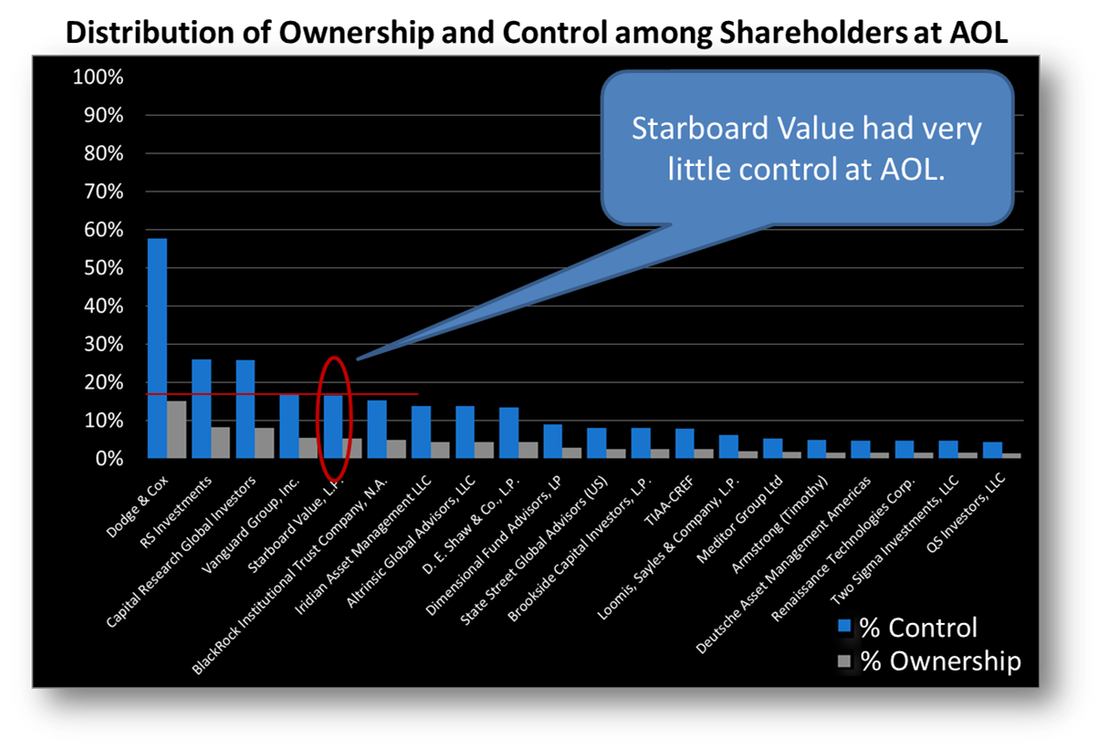

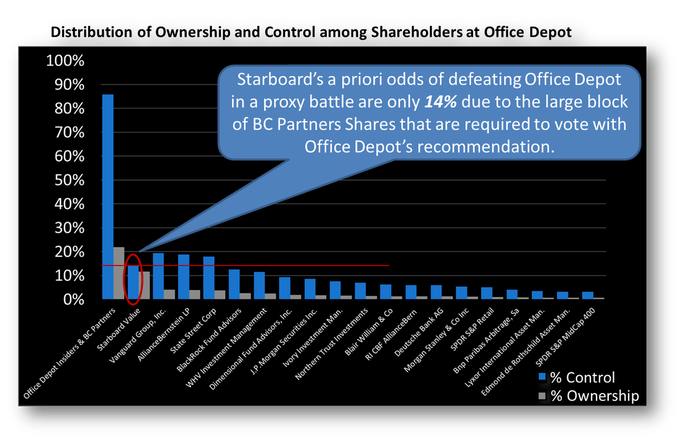

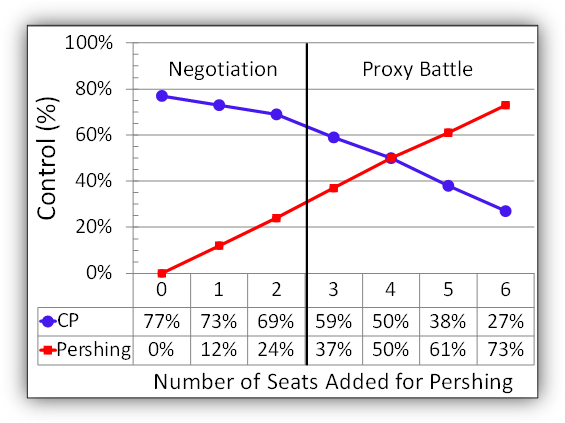

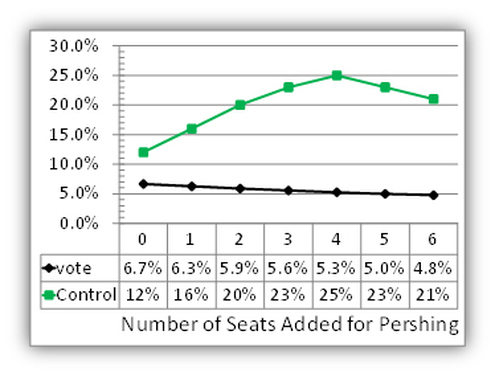

Because proxy battles are determined by shareholder votes, they are dominated by those who have more control. Without going into too much math, more ownership could imply more control but it can get way more complicated than that – because it depends on how much ownership other people have. Think Poker: your odds of winning depend on what you have, AND the hand of the other people around the table. There might even be bluffing involved – just kidding (or am I?).

Who determines the outcome of proxy battles?

Normally in a situation like this the destiny of a company is determined by one of three parties: insiders, the activists, and other large shareholders.

What does this mean for your investment?

Statistically speaking, activism is typically really good for investments. According to a plethora of academic studies activism returns are significantly better than the market in general. See figure 1. So, on the plus side, you can be happy your investment has enough ‘hidden’ value to attract an activist (because it puts your apple investment in a category that, as a group, earns much more than the market as a whole).

‘Big’ must naturally go with ‘Apple’. With more than 900 million shares trading on NASDAQ, at times with over 50 million per day, calling Apple popular is an understatement. From hedge fund managers and analysts to iphone owners, diverse investor groups profess an unconditional love for Apple. Now, the biggest bad boy in finance has shown up at Apple and you see his name plastered across the media: Carl Icahn. But the average household investor has no idea who Carl is, and what activist investors are. Should you worry or rejoice? Do activists tend to propel companies or bring them down?

Typically, my startup Rotary Gallop does not have the pleasure of having its killer app be so relevant to our friends and family – so this post is especially for you. For the lot of you, who don’t know who Carl is and what activists do – typically because they tend to show up at companies with really serious problems and not ones which have the luxury of having more cash reserves than the GDP of more than 70% of the countries. So, here is a FAQ on whats happening at Apple.

Remember, we cannot legally give you financial advice but we can certainly discuss financial activism 101, general trends, and results from Rotary Gallop’s number crunching.

Part I: Financial activists 101 (Skip if this is familiar territory)

Who is Carl Icahn and what does he want with Apple:

Carl Icahn is perhaps the most famous activist investor. An activist investor is someone who thinks they see value in a company that other don’t AND work publicly to make the market recognize that value. So what does Icahn see that others don’t in the most watched stock in the world, Apple?

Cold hard cash to the tune of $150 Billion. To put that in perspective, there are only about 30 companies in the world, that Apple could not buy outright with its cash laying around. If countries were for sale, Apple could own 70% of the world and christen them United States of Apple or Applesia and continue its normal operations. And to relate to the young investors, that’s a 150 Instagram impulse buys Tim Cook can afford!

To any business savvy investor, this kind of immense cash reserves is a huge waste. That’s the equivalent of hiding your savings under the mattress – a strategy most financial advisors advice against. And to activist investors who look to uncover valueat good businesses executing bad strategy, the huge cash reserves are like catnip.

Icahn is asking Apple to use a good chunk of its cash reserves to buy back its own stock.

What value can you uncover at Apple?

Apple is a stock valued largely on matters other than its balance sheet. Some investors value Apple for its earnings, some for growth, for many its new products, or product pipeline, or the fact that Apple users spend vastly more on apps than other platforms. Almost no one values Apple by its balance sheet assets. Thus, a pile of cash worth more than 30% of Apples market cap is an enormous hidden value that makes an activist’s mouth water.

Why do companies need a cash stock pile?

Several good reasons, including the ability to invest in new opportunities, projects, acquisitions, etc.

What do most companies do with their cash stock pile? Give it back to shareholders as dividends or re-invest in opportunities which have potentially higher-than-market returns.

Why will Apple spending its cash to buy back its own stock help uncover value?

In the Short term: Apple, suddenly in the market for 30% of its trading securities, skyrockets the demand for and hence the price of apple stock.

In the Long Term: Since Apple is not primarily valued on its assets but on its earnings, the buyback is unlikely to change the market valuation of the company as a whole. Thus, even once Apple stops buying the share price is likely to trade approximately 1/.7=42% higher.

What is the downside of this stock buyback strategy?

Returning the massive amount of cash back to its investors is great in the short term. The downside is that we won’t get to see what happens 5-10 years from now once Apple has had the chance to invest the largest war chest in history in its business.

Ok. What does all this boil down to?

It comes down to this:

Do you want this massive pile of cash invested by apple and are you willing to wait for when that happens? Or would you rather take that money and invest it elsewhere yourself where the compounding magic can start right away? While that sounds like a flippant question, statistically speaking both are pretty crummy bets.

If you are not a buy and hold type gal/guy, then it really doesn’t matter, does it?

So, what happens now?

Ultimately these disputes are settled by a shareholder vote called a proxy battle, or more often by the threat of a proxy battle.

Part II: How Rotary Gallop’s technology quantitatively reveals what is happening at Apple

Because proxy battles are determined by shareholder votes, they are dominated by those who have more control. Without going into too much math, more ownership could imply more control but it can get way more complicated than that – because it depends on how much ownership other people have. Think Poker: your odds of winning depend on what you have, AND the hand of the other people around the table. There might even be bluffing involved – just kidding (or am I?).

Who determines the outcome of proxy battles?

Normally in a situation like this the destiny of a company is determined by one of three parties: insiders, the activists, and other large shareholders.

What does this mean for your investment?

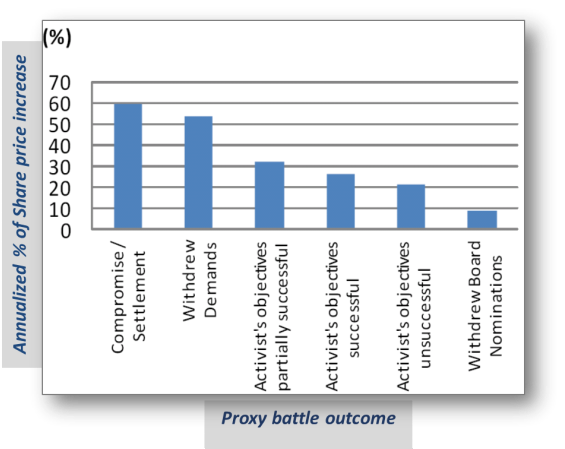

Statistically speaking, activism is typically really good for investments. According to a plethora of academic studies activism returns are significantly better than the market in general. See figure 1. So, on the plus side, you can be happy your investment has enough ‘hidden’ value to attract an activist (because it puts your apple investment in a category that, as a group, earns much more than the market as a whole).

Figure 1: Performance of US companies by activist campaigns. % Share price annualized increase from day of first 13D disclosure. Figure from Activist Insight.Results corroborated by and very similar to Rotary Gallop’s in- house studies.

What has Rotary Gallop found from analyzing past activist investments?

Rotary Gallop offers three main take aways from our backtests on activist investments.

How long will this take?

Don’t expect either side to fold quickly, just because compromise if the best outcome. This is like court where the best outcome happens when each side argues their strongest case.

In summary:

Relax: and know that statistically you are close to a no lose scenario.

Be Happy: your investment has enough hidden value to attract an activist puts your apple investment in a category that earns much more than the market as a whole.

Hope for a Big Win: Statistically, the best case scenario for you and Apple the company – that Management and shareholders come to some agreement about the best future course. On average this is in fact 4x better than market returns.

Take Part: despite Apples size, in fact because of apples size, the votes will really matter here if that is what is comes down too. So take part and know that your vote counts!

Don’t stress: if agreement doesn’t come quickly, don’t worry! Much like a trial, both sides see it as their duty to make the strongest case possible before submitting to the judgment of the jury.

Disclaimer: NO FINANCIAL ADVICE - The Information on this blog is provided for education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on this site AT YOUR OWN RISK.

What has Rotary Gallop found from analyzing past activist investments?

Rotary Gallop offers three main take aways from our backtests on activist investments.

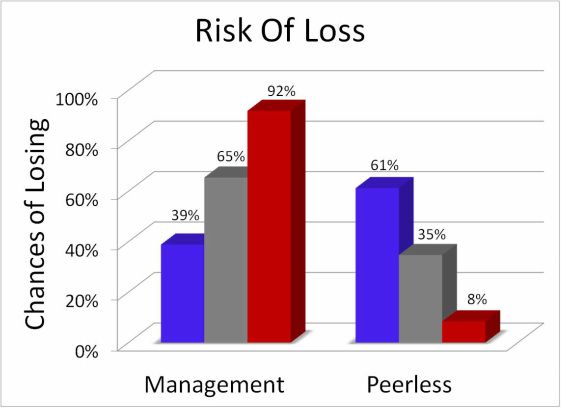

- Unsuccessful activism “only” has market returns: On average situations where an activist is completely unsuccessful, they deliver market returns. So know that statistically you are close to a no lose scenario.

- Successful activism is nearly twice as good: Activists who end up achieving everything they set out to, on average return ~26%,

- Agreement between activist and management is twice as good as that! In situations where management and activists come to an agreement and work together, the returns are again much greater.

How long will this take?

Don’t expect either side to fold quickly, just because compromise if the best outcome. This is like court where the best outcome happens when each side argues their strongest case.

In summary:

Relax: and know that statistically you are close to a no lose scenario.

Be Happy: your investment has enough hidden value to attract an activist puts your apple investment in a category that earns much more than the market as a whole.

Hope for a Big Win: Statistically, the best case scenario for you and Apple the company – that Management and shareholders come to some agreement about the best future course. On average this is in fact 4x better than market returns.

Take Part: despite Apples size, in fact because of apples size, the votes will really matter here if that is what is comes down too. So take part and know that your vote counts!

Don’t stress: if agreement doesn’t come quickly, don’t worry! Much like a trial, both sides see it as their duty to make the strongest case possible before submitting to the judgment of the jury.

Disclaimer: NO FINANCIAL ADVICE - The Information on this blog is provided for education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on this site AT YOUR OWN RISK.

RSS Feed

RSS Feed