A case in the news beautifully highlights a fact we observe in engagement after engagement: going from qualitative fuzzy adjectives (traditional proxy strategy advice) to quantitative hard numbers can be a gamechanger! Even when the situation appears blatantly obvious, cold hard numbers give a new perspective like no other. Case in point: ModusLink Global Solutions, Inc (NasdaqGS: MLNK ) featuring Peerless Systems Corp. (PRLS) and Steel Partners.

For the second year in a row, ModusLink is having an eventful proxy season. For a great summary, check out the October 28th edition of the always useful Catalyst Equity Research Report . This year, management faces Peerless Systems’ seasoned activist Timothy Brog. He is backed by an amalgam of varied and vocal supporters, totaling roughly 11% ownership. This is significant activist power. Peerless is seeking to replace two directors up for election this year.

As far as we've been able to determine, Steel Partners, the 800-pound gorilla in the room and largest shareholder by far with nearly 12% ownership, has not publicly announced allegiance to either side. One might rightly assume the obvious: that Steel Partners is a huge prize in the contest and that they may have significant negotiating power with both management and Peerless Systems.

However, as a decision executive at one of the involved parties, how do I use this information? What do I do with an adjective like “significant” or “huge”? How do I weigh "significant" against the actual costs and changes that Steel Partners might like to see in order to support me? And what does “significant” really mean, coming from an advisor who may have a different gut-calibration than myself? Answer: It is a big fat ambiguous term that in turn results in a big fat clumsy strategy.

We can do better. Rotary Gallop's Control Measurement techniques crush fuzzy adjectives and presents tangible numbers. Numbers that you can touch and feel, weigh and measure, and then use to think. Numbers that exactly measure the power and influence of each shareholder. In the case of ModusLink, at Rotary Gallop we take “significant” and give you:

For the second year in a row, ModusLink is having an eventful proxy season. For a great summary, check out the October 28th edition of the always useful Catalyst Equity Research Report . This year, management faces Peerless Systems’ seasoned activist Timothy Brog. He is backed by an amalgam of varied and vocal supporters, totaling roughly 11% ownership. This is significant activist power. Peerless is seeking to replace two directors up for election this year.

As far as we've been able to determine, Steel Partners, the 800-pound gorilla in the room and largest shareholder by far with nearly 12% ownership, has not publicly announced allegiance to either side. One might rightly assume the obvious: that Steel Partners is a huge prize in the contest and that they may have significant negotiating power with both management and Peerless Systems.

However, as a decision executive at one of the involved parties, how do I use this information? What do I do with an adjective like “significant” or “huge”? How do I weigh "significant" against the actual costs and changes that Steel Partners might like to see in order to support me? And what does “significant” really mean, coming from an advisor who may have a different gut-calibration than myself? Answer: It is a big fat ambiguous term that in turn results in a big fat clumsy strategy.

We can do better. Rotary Gallop's Control Measurement techniques crush fuzzy adjectives and presents tangible numbers. Numbers that you can touch and feel, weigh and measure, and then use to think. Numbers that exactly measure the power and influence of each shareholder. In the case of ModusLink, at Rotary Gallop we take “significant” and give you:

Steel partners has a voting power of 53%. In the upcoming proxy battle this January, there is a 53% chance that Steel Partners will cast the deciding vote.

Take a moment to appreciate what just happened. We've gone from an adjective like "significant", to knowing the odds that Steel Partners will be the deciding factor in the election. Now that is a giant leap forward! And the beauty of numbers is that we can make the connection between Steel Partners and the fate of the opposing campaigns even more direct.

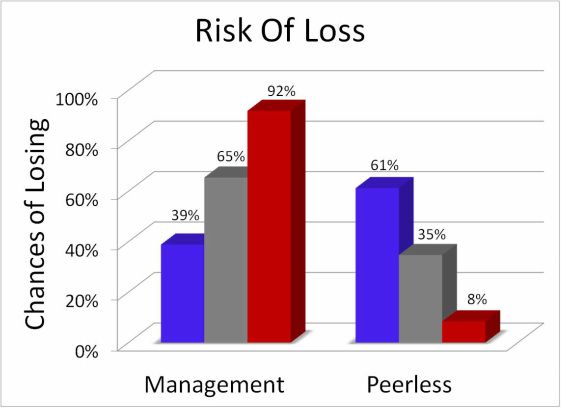

Presenting Exhibit 1: Management and Peerless’s Risk of loss

We have directly measured the "significance" of Steel Partners’ decision to Peerless and ModusLink. Look at the middle gray columns in the graph below. With Steel Partners remaining undecided, ModusLink has a 65% chance of losing, while Peerless has a 35% percent chance of losing. That is a fairly wide-open race, with management winning 7 out of 20 times.

If Steel Partners sides with ModusLink (blue columns) the tables turn but the race still remains quite wide open. Peerless has a 61% chance of loss while ModusLink now has only a 39% percent chance of loss. (ModusLink now wins 12 out of 20 times). If, on the other hand, Steel Partners sides with Peerless (red columns) we have a much more drastic change in the character of the race, with ModusLink's risk of loss shooting all the way up to 92% percent and Peerless’s dropping to only 8%!

Using an adjective, like significant, to communicate the importance of Steel Partners completely misses the key observation that their value is asymmetric. In siding with ModusLink, Steel Partners does not change the character of the race – it still remains essentially open. However, in siding with Peerless, Steel Partners makes a proxy win nearly impossible for ModusLink’s and the game changes from a contest to one of negotiations. Thus, from Peerless’s point of view, Steel Partners represents a primarily offensive opportunity (a game winning strategy), while ModusLink should see them as primarily defensive (a stay-in-the-game strategy).

Now Peerless, ModusLink, and Steel Partners all know just how valuable Steel Partner’s decision is to each party and they will all be able to make much more intelligent decisions about what concessions are and aren’t worth Steel Partners' support. Having at least this part of the competitive landscape in sharp focus will help the decision makers at Peerless and ModusLink as they head towards the election in January. And for other decision makers and advisers our there: You don’t have to put together your strategy while viewing the battle field through a dirty coke bottle. We have satellite images!

As I sign out, I’ll note that we can go another step further and put a monetary value on Steel Partners' Vote for both Peerless and ModusLink, but that’s a post for another day. Let me know what you think!

-Travis

Using an adjective, like significant, to communicate the importance of Steel Partners completely misses the key observation that their value is asymmetric. In siding with ModusLink, Steel Partners does not change the character of the race – it still remains essentially open. However, in siding with Peerless, Steel Partners makes a proxy win nearly impossible for ModusLink’s and the game changes from a contest to one of negotiations. Thus, from Peerless’s point of view, Steel Partners represents a primarily offensive opportunity (a game winning strategy), while ModusLink should see them as primarily defensive (a stay-in-the-game strategy).

Now Peerless, ModusLink, and Steel Partners all know just how valuable Steel Partner’s decision is to each party and they will all be able to make much more intelligent decisions about what concessions are and aren’t worth Steel Partners' support. Having at least this part of the competitive landscape in sharp focus will help the decision makers at Peerless and ModusLink as they head towards the election in January. And for other decision makers and advisers our there: You don’t have to put together your strategy while viewing the battle field through a dirty coke bottle. We have satellite images!

As I sign out, I’ll note that we can go another step further and put a monetary value on Steel Partners' Vote for both Peerless and ModusLink, but that’s a post for another day. Let me know what you think!

-Travis

RSS Feed

RSS Feed