There are known knowns; there are things we know that we know.

There are known unknowns; that is to say, there are things that we now know we don't know.

But there are also unknown unknowns – there are things we do not know we don't know.

— United States Secretary of Defense, Donald Rumsfeld

The famous observation above misses an important category. There are also unknown knowns; there are things you don't know you know. Until recently, I had a pocket of knowledge in the last category: what leads an activist to a particular company.

Two Minute Version:

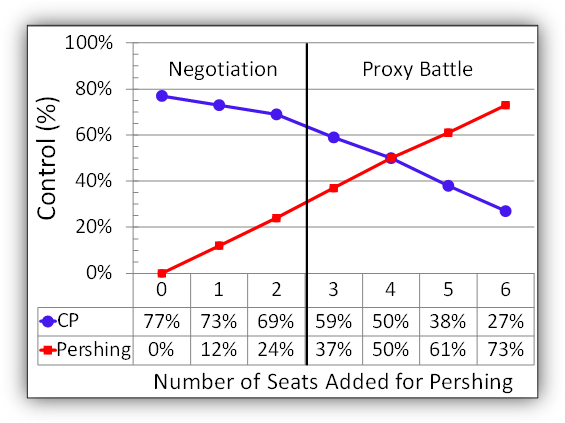

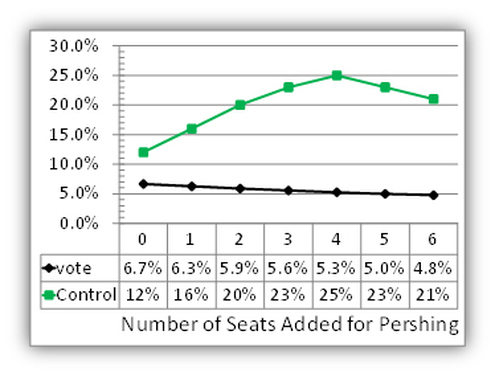

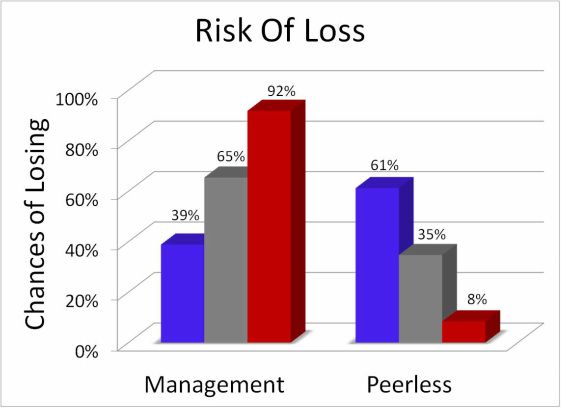

There are three pieces to a successful activist campaign. First is some perceived hidden value. Second, the ability to buy in and own it. And finally there is the activist's ability to uncover that value, either by convincing management to take some action or forcing them to through the shareholder voting process. A company must have all three to be interesting to a (sane) activist. |

Below I've unpacked it and given some common factors that lead to activism, but the beauty is that once you've grasped it, you can apply it to your own situation and find the relevant factors yourself. Its a framework that will allow you to access a company's chances of being attacked. It is also quite useful for a company, which wishes to reduce their chances of such an encounter, as well as, for an activist seeking to maximize returns.

RSS Feed

RSS Feed