(Originally a Guest Post for The Activist Investor. )There is a perception among many that granting an activist significant board representation over and above what ownership might indicate grants unfair and detrimental control to the activist. Such an action is often derided as a stealth takeover, or a takeover with no premium.

However, granting an activist significant board representation, to balance the secured votes of management, actually transfers significant power to the unaligned board members already serving. Those unaligned board members (with significant ties to neither management nor the activist) are utterly familiar with the company and its problems, but have not had sufficient voice to cause change. It may be that the best effect an activist has, even one without a detailed, 30 point, 5-year plan, is to cause this shift in power towards these already serving board members.

The unfolding drama between the current management of Canadian Pacific Railway and Bill Ackman of Pershing Square Capital Management, L.P. offers a prime example. Pershing is seeking 5 board seats on a 15 member board while owning only 14% of outstanding shares. To some, this may seem like an undue amount of representation. However, we find that far from concentrating power in the hands of Pershing Square, granting Pershing significant representation would actually result in a much more even distribution of power on the board of directors.

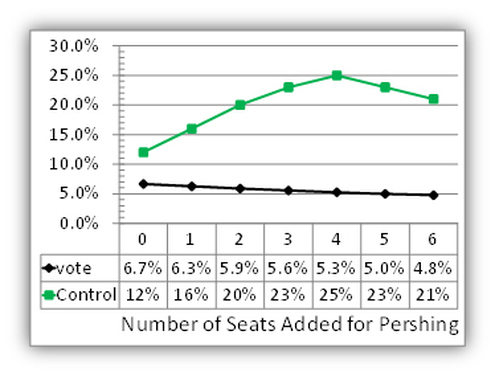

Since things are in the late negotiating stages, with management offering Pershing a single seat, we looked at what would happen to the distribution of power on Canadian Pacific Railway’s board of directors if Pershing Square were granted 1, 2, 3, 4, 5, or 6 additional seats. As Pershing is granted more seats the unaligned board members’ power increases significantly, as seen in the graph below. In fact, when Pershing Square is granted four seats, matching management’s secured votes[1], the power of the unaligned board members more than doubles to 25%!

Exhibit 1: As Bill Ackman and Pershing square receive more seats the unaligned board members’ control increases, more than doubling at 4 seats for Pershing. Notice that the unaligned board members’ power grows even as their percentage of the vote shrinks steadily. As we move to the right on the horizontal axis we see the percentage of the total vote (black) and Control (Green) of each unaligned board member if Bill Ackman is given 0, 1, 2, 3, 4, 5, or 6 seats added to the board.

It can, and perhaps ought to, be argued that this spreading of power on the board is exactly what one would hope for at a time when a new direction is necessary. Such a leveling effect will allow new ideas to more effectively compete, whether they come from Pershing or the unaligned board members familiar with Canadian Pacific’s problems.

We wonder how much of activists’ proven effectiveness at delivering returns stems from this simple redistribution of power to previously disenfranchised, but established board members. Let us know what you think in the comments below!

We wonder how much of activists’ proven effectiveness at delivering returns stems from this simple redistribution of power to previously disenfranchised, but established board members. Let us know what you think in the comments below!

[1] For these calculations we have assumed that management controls 4 of the 15 votes on the board of directors. We have no inside knowledge and have never spoken to anyone on the board. However, we do believe this is a conservative assumption, given that 5 board members have been on the board for 10 years, one board member is the CEO, two board members joined the board in the same month as the CEO, and two board members were appointed in the face of Pershing’s activism.

RSS Feed

RSS Feed